It is tax time again, which means IRS scams are once again on the rise here in Houston and throughout the United States. Predictably, many of the victims of this scam are the elderly, since they are often the most vulnerable.

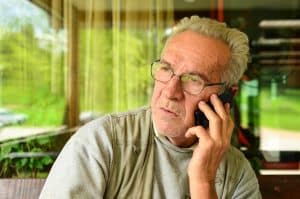

Victims are contacted in a variety of ways, but the most common method is to reach them by phone. In the latest IRS scams going around, the scammer will claim to be an IRS agent and either ask for personal information (to steal the senior’s identity) or demand immediate payment over the phone.

Victims are contacted in a variety of ways, but the most common method is to reach them by phone. In the latest IRS scams going around, the scammer will claim to be an IRS agent and either ask for personal information (to steal the senior’s identity) or demand immediate payment over the phone.

If the victim refuses to give the information or provide payment, the caller may become hostile and aggressive and threaten to have the senior arrested. This insidious method works more often than you think, so we encourage you to talk to your elderly loved ones. Here are a few of the red flags you can tell them to watch for:

Please be aware that some of these scammers are very convincing and they may already know some personal information that is online or apart of the public record. But, if you suspect that the person on the other end of the line is not who they say they are, just hang up and report the call to your local law enforcement authorities.

If you are worried about yourself or elderly loved ones falling victim to these types senior scams, call our Houston elder law attorneys at (281) 885-8826 so that we can help protect your finances.

Kimberly Hegwood is the Managing Attorney of Your Legacy Legal Care, a Houston estate planning law firm. With more than 25 years of experience practicing law in Texas, she represents clients in a wide range of legal matters, including elder law, asset protection, estate planning, Medicaid crisis planning, probate, guardianship, and other estate planning practice areas.

Kimberly received her Juris Doctor from the South Texas College of Law and is a member of the State Bar of Texas.

Your Legacy Legal Care